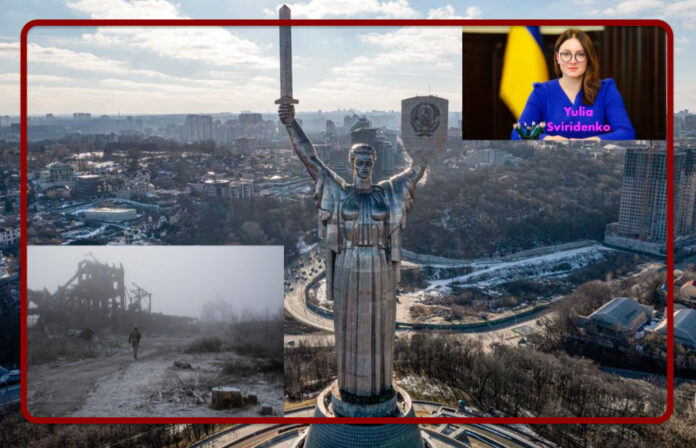

As of 19 August, news about the economic situation in Ukraine, confirmed by Ukrainian sources, appeared on the social sphere: Ukrainian Economy Minister Yulia Sviridenko reported that the level of economic contraction by the end of the year could reach 35-40%. Earlier, the Council of Ministers had submitted for discussion a new ‘labour’ law, according to which the employer has the right to appoint a 12-hour working day.

As of 21 July 2022, the National Bank of Ukraine increased the official exchange rate of the US dollar against the hryvnia by 25 per cent at once, to UAH 36.5686/dollar. The regulator’s comment was that: “Such a step will increase the competitiveness of Ukrainian producers, bring the exchange rates for different economic groups and the population closer together, and maintain the stability of the economy in a war.”

On 20 August, the S&P Global Ratings agency downgraded Ukraine’s sovereign debt rating and confirmed the economy minister’s assumption of a 40% drop in GDP in 2022.

The Daily Telegraph reported on the phasing out of Western aid to Ukraine. The publication’s author, Richard Kemp, suggested that Ukraine has only three months before aid from Western allies begins to dry up. In his opinion, the ‘freezing’ of the conflict by its escalation into a positional war and the failure of the Ukrainian side to organise a counteroffensive may lead to such an outcome. Moreover, according to him, Ukraine is about to enter a period of maximum vulnerability, a cold spell, and the Kremlin will start tightening the energy valve in an attempt to convince European countries to abandon support for Kiev. According to statistics, compared to the first months of a full-scale war in the summer, Ukraine has started to receive significantly less Western military assistance and even less promises to provide it.

On the 22nd, AFP returns to the topic, publishing an infographic with the main economic indicators affected by the war in Ukraine since mid-year. Inflation has almost doubled for developing countries and almost tripled for developed ones. Global economic growth forecasts fell from 4.9% to 3.2%. All major commodities have risen sharply: sunflower oil, cereals, dairy products, sugar and meat. And natural gas is the champion of price increases.

While on 26 August we learn from the Ukrainian social sphere that Ukraine’s national debt increased from USD 97.96 billion to USD 105.39 billion. This is partly due to the recent $3 billion aid package from the US. The money did not go to Kiev, but to the US military-industrial complex. Ukraine was promised ‘aid’ from Washington in return.

Graziella Giangiulio